WHAT PRICE REPUTATION:

An investigation into corporate reputation management in the FTSE250

5. MANAGING REPUTATION

FTSE250 CEO

THE INHOUSE MODEL

Former FTSE250 CEO

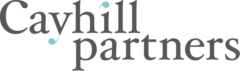

- 54% have an inhouse function6

Just over half (54%) of FTSE250 companies employ inhouse, group-level communications functions, and the larger their market cap, the more likely they are to have this dedicated resource. This compares with the FTSE100 where around 78% have group inhouse corporate communications. Most FTSE250 communications functions are made up of senior staff responsible for plc communications and corporate reputation, with just 14% operating at a junior level (such as limited press office duties).Corporate communications responsibilities in the FTSE250 are diverse and many communications leaders have broader remits than their peers in the FTSE100. Much is dependent on the CEO and their understanding of, or support for the discipline.

Almost all the FTSE250 communications leaders we spoke to are responsible for financial PR, media relations and plc/corporate communications (to include thought leadership, executive profiling etc). Around half are also responsible for overseeing public affairs and internal communications, the latter usually sitting with the human resources function if not with communications. Some have an even wider brief, successfully integrating communications as a core business function. The size of FTSE250 communications teams varies enormously, ranging from one through to over 100. The average team size is 13.

- The majority report to the CEO7

The wide remit of the role makes for varied reporting lines. Some make sense, whilst others are due to personalities and legacy issues rather than any meaningful structure.

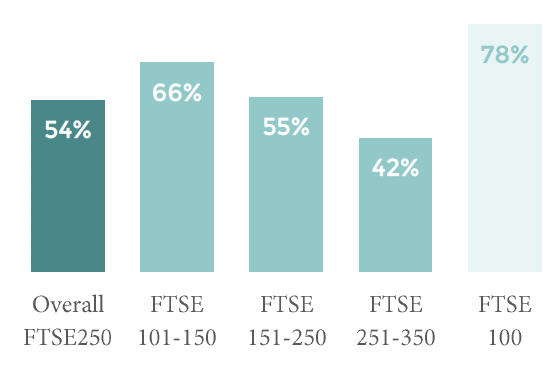

REPORTING LINES FOR FTSE250 GROUP COMMUNICATIONS LEADERS

- › A small majority (54%) report to the CEO, compared with 75% in the FTSE100.

- › The next most common reporting structure, particularly within FMCG companies, is into the marketing function. The 21% of communications leaders in this set-up often have marcoms responsibilities and can find their focus pulled more toward product communications than wider corporate reputation.

- › Around 13% report to the chief financial officer (CFO), the vast majority of whom are responsible for both communications and investor relations. This compares with around 4% in the FTSE 100. Some respondents report to both the CEO and CFO which can cause challenges.

- › Just 2% report to the human resources function. This reporting line tends to dominate when the company has a focus on internal rather than external communications.

- › Other reporting lines uncovered include to the head of strategy & research, and to the executive chairman.

- 43% are members of the executive committee

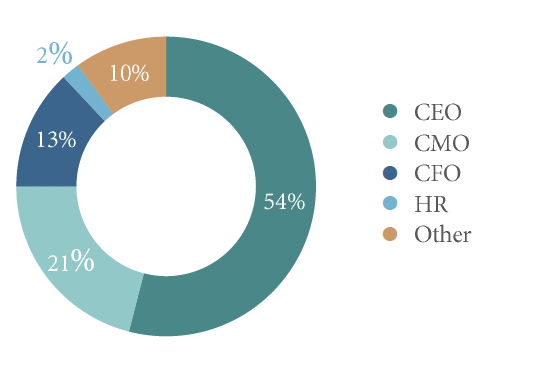

- 68% prioritise investor relations (IR) functions inhouse

FTSE250 firms appear to see shareholders as their most important stakeholders. Almost two thirds (68%) employ dedicated inhouse investor relations capability, compared to the 54% that employ inhouse group corporate communications. Unsurprisingly, the larger the company the greater the likelihood of there being an inhouse IR leader.PERCENTAGE OF FTSE250 FIRMS THAT EMPLOY IN-HOUSE GROUP LEVEL INVESTOR RELATIONS

- 15% combine communications & IR functions inhouse

Some organisations combine the IR role with disciplines including finance (3%) and strategy (2%). But by far the most common combination is with communications.

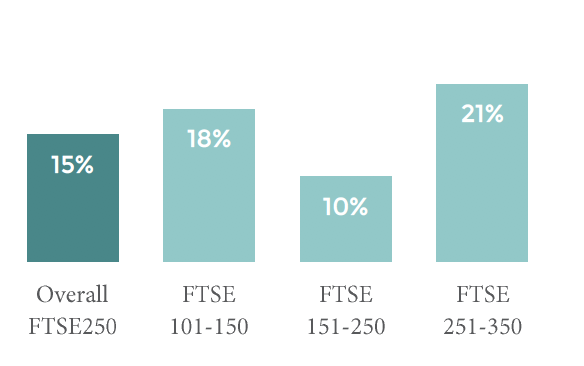

Smaller FTSE250 firms are more likely to merge the communications and IR roles, reflecting the genesis of investor relations as the first ‘must have’ for an IPO (see chapter 5); firms often hire an investor relations executive first and then bolt on communications to their remit. Among the 15% of companies following this model, the function is most commonly led by someone with an investor relations background. However, there are considerable variances across the indices as shown in the table below.COMBINED GROUP COMMUNICATIONS AND IR ROLES WITHIN FTSE250 COMPANIES

The advantages to a company of this joint role are:

- easier on the budget,

- joined up messaging – the days of being able to segment audiences and the channels to reach them are fading fast so firms benefit from a single point of responsibility, and

- many FTSE250 companies are less siloed than FTSE100s and prefer hiring professionals with a breadth of skills.

- A reported downside of the shared role can be a predominant focus on investor relations activities at the expense of wider corporate reputation management, particularly if the role reports to the CFO.

- From the postholder perspective, there are clear advantages to having a joint communications & IR position. In the right hands, the combined responsibilities can make for a very powerful role with oversight of some of the organisation’s most important stakeholders including investors, politicians, the media, employees and the City. The heavy focus on financial literacy gives the position additional credibility amongst CEOs and the executive team, many of whom rely on the postholder to simplify the narrative around results and add a level of expertise when speaking to senior investors and the like.

“Our staff sharesave scheme means that everyone from the shop floor through to the board is interested in how our company is doing financially and what is driving the share price. I can help them understand that by telling them what the outside world is thinking of us”.

FTSE250 Investor Relations & Corporate Communications Director

The larger the company, the more likely it is that the communications function will be represented on the executive committee (ExCom). In many cases, the communications role did not automatically come with a seat at the top table and had to be ‘earned’ by the communications director either through long or good service. However, the corporate communications leader may also be the only direct report into the CEO who isn’t on the executive committee, attending these meetings as a guest or observer rather than as a formal participant. And conversely, illustrating just how seriously the role is taken in some organisations, as well as being members of the executive committee, communications leaders also sit on their RemCo and corporate governance bodies.

- <5% have no corporate communications or PR agency support

There is a handful of companies (fewer than 5) in the FTSE2508 that appear to have no group or plc communications support at all, either via an agency or inhouse. These companies, predominately in the consumer goods/services sector, offer a very limited corporate communications service (reactive media relations, press releases etc) either via their marketing function (mostly product & trade PR) or their finance function (limited investor relations and financial PR activities). Whilst this can work for some organisations, it does mean that these two functions can be overloaded. Where finance or treasury are responsible for communications services, activities tend to be ‘spreadsheet driven’, with little or no focus on distilling financials into a coherent and simple to understand narrative.“My CFO is creaking at the corners trying to deliver financial PR support along with his day job”.

FTSE250 CEO - >91% also have a retained PR consultancy

Only a tiny minority (~2%) of FTSE250 organisations have an inhouse group corporate communications capability with no PR consultancy support. In the hands of a talented communications team this can work, but it can be difficult to ensure ready access to an external, objective perspective on reputational issues and may result in the inhouse team focusing on tactical delivery of campaigns at the expense of the strategic.The vast majority of FTSE250 companies with dedicated inhouse group communications also retain a PR consultancy. These provide group corporate & financial communications services, with around 17% also being responsible for investor relations activities. Most FTSE250 firms use one agency to cover both financial and corporate PR although there are some that use separate agencies for each.

“Having good senior inhouse people that the CEO can trust is crucial, whilst also drawing on the skills of an agency. I’m a big fan of having a mixed model, i.e. inhouse with agency support”.

FTSE250 Communications Leader

THE AGENCY MODEL

Size matters when it comes to deciding whether to have inhouse resource or PR agency support. Smaller FTSE250 firms often don’t have the budget to appoint both and need to decide between the two options. The decision can be part of a broader philosophy about how the company uses external agencies, or it could be a matter of getting headcount down (or not increasing it). But that choice is often preceded by very little discussion about what corporate communications should be delivering for the organisation. The consequence is that companies can often end up spending more on agencies than they envisaged or would have done if they appointed someone inhouse. For bigger companies with larger budgets, there is tangible benefit to having both inhouse and agency support. PR agencies can add real value, particularly on a regional and local basis where it is not practicable to employ local communications staff.

FTSE250 CEO

- 45% rely on agency support alone

Just under half (45%) of FTSE250 firms rely entirely on PR agency support and have no dedicated group communications capability inhouse. The appointment of a PR consultancy to oversee financial and corporate PR is often the first step in an organisation’s move towards implementing a dedicated corporate reputation management capability. But it can bring its own challenges. Since there is no inhouse communications team to report to, these PR agencies are typically managed by the chief financial officer, chief executive, chief marketing officer or human resources director. Managing a PR agency can be a full-time role in itself. Time pressures, a lack of understanding of corporate reputation management and an inability to set clear communications objectives means that PR agencies can be frustrated by these reporting lines and are often, in the absence of regular and relevant information from the company, unable to deliver value for money.“Using only a PR agency you can limp on for a while, but you need a clear point of responsibility inhouse in order to manage the relationship. And in order to manage the agency adequately, that person needs to understand corporate communications”.

FTSE250 Communications Leader

WHAT PRICE COMMUNICATIONS?

AGENCY FEES

Retained PR consultancy fees across the FTSE250 range from about £30,000 a year (£2,500 per month) to over £750,000 per year (£25,000+ per month). The average monthly fee is £10,625. Higher monthly fees (£20k+ per month) tend to be paid by FTSE companies that were previously FTSE100 organisations but have since dropped down the index (with no corresponding drop in consultancy fees), or that have complex consultancy needs such as cross-border briefs or a requirement for intense work due to high levels of public interest. Those FTSE250 organisations paying lower fees (sub £7k per month) are typically using smaller, boutique consultancies and have more simple requirements, usually focusing on calendar work and quarterly reporting.

PR CONSULTANCY FEES IN THE FTSE250

INHOUSE COMMUNICATIONS LEADERSHIP COSTS 9

FTSE250 companies have markedly different budgeting models for their corporate communications functions and so it has not been possible to include comparable figures for departmental expenditure apart from salaries.

- Base salaries for group communications leaders in FTSE250s range from £75,000 to £275,000+ per annum. This wide range is understandable, given the breadth of responsibilities and various reporting lines of the individual post-holders.

- The average base salary for FTSE250 comms leaders is £158,000 per year. Unlike in the FTSE100 where there tends to be a much closer correlation between base salary and market cap, in the FTSE250, this is much less so. Salaries are more aligned to the complexity of the organisation, the breadth of the remit, the seniority of the role, geographical footprint and the organisation’s or CEO’s belief in the importance of the role. Some industries pay more, such as technology and financial services.

INHOUSE CORPORATE COMMUNICATIONS SALARIES IN THE FTSE250

Base salaries in the FTSE151 to 250 are higher than in FTSE111 to 151. This is due to factors such as the inclusion of some complex organisations with high profiles and heavy regulation issues that warrant more sophisticated levels of communications expertise.

5/6 More details available, hello@cayhillpartners.com

7 More details available, hello@cayhillpartners.com

8 Excludes investment trusts/fund, and non -UK HQ organisations

9 More details available, hello@cayhillpartners.com