WHAT PRICE REPUTATION:

An investigation into corporate reputation management in the FTSE250

6. DEVELOPING CORPORATE

COMMUNICATIONS CAPABILITY

WHAT PRICE REPUTATION:

An investigation into corporate reputation management in the FTSE250

6. DEVELOPING CORPORATE COMMUNICATIONS CAPABILITY

There is no ‘right time’ to appoint inhouse resource. The decision will vary from organisation to organisation and depends on several interlinked factors such as the company’s size, its sector and levels of scrutiny, its strategy and plans for growth, its reputation and the CEO or chairman’s understanding of and belief in corporate reputation management.

FTSE250 CEO

Some corporate happenings tend to fast-track the decision to hire in inhouse communications resource. These include financial transactions such as IPOs, mergers or rights issues, changes in strategy or business transformations, diversifying or increasing the shareholder base, stalling growth, an incorrect market valuation, increasing growth, positioning the company as a unified entity, a new CEO or chair, a misunderstood company strategy, or a crisis.

The decision to hire most often comes from the chair at the top, followed by the CEO and CFO, usually driven by advisers such as brokers and NEDs

FTSE250 CEO

Most FTSE250 firms seem to follow a reasonably well-worn path when bringing in specialist corporate reputation management capability. This usually starts with the use of a PR consultancy on an ad hoc basis, through to the appointment of a senior inhouse corporate affairs director that reports to the CEO and is a member of the executive committee.

EVOLUTION OF CORPORATE COMMUNICATIONS AND INVESTOR RELATIONS CAPABILITY IN THE FTSE 250

THE MOVE TO FTSE10011

What changes as a FTSE250 company prepares for the FTSE100?

Generally, the imperative to step up communications comes from the level of external interest in a company, rather than its market cap per se. Indeed, for some high-profile organisations, it makes very little difference which index they sit in. However, smaller companies will generally not need the more sophisticated elements that much better-known FTSE 100 companies require.

FTSE250 Corporate Affairs Director

There is an obvious distinction between an organisation moving up to the FTSE100 through organic growth versus a business getting there via a large merger or acquisition. If a FTSE250 organisation is knocking on the door of the FTSE100 through steady growth, any adjustments that need to be made will likely be incremental rather than tectonic. Conversely, those firms suddenly landing in the FTSE100 as a result of an acquisition will often have immediate challenges to wrestle with and a much bigger corporate reputation management transition to make.

Former FTSE100 Communications Head

In summary:

- Profile: increased scrutiny from media, shareholders, government, customers and the public at large, particularly if the company is consumer-facing.

“You can be left a little bit more alone in a FTSE250. The benefit is that you have more time to develop a campaign, but the downside is that it’s harder to get airtime”.

FTSE250 VP Corporate Communications - ExCom/board experience: The ExCom of a FTSE100 firm is typically populated by executives with previous leadership roles under their belt, with similarly experienced boards.

“I was the first communications director that my firm hired, and I had to spend the first six months of my tenure educating the executive team and board about what corporate reputation management was and what is wasn’t”.

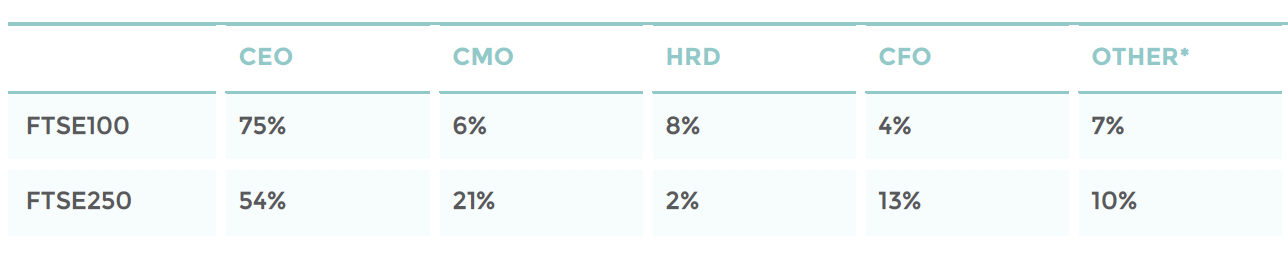

FTSE250 Head of Communications - Reporting lines: The larger the organisation, the more senior the communications reporting lines tend to be. In FTSE100 organisations, two thirds (75%) of communications leaders report to the CEO, compared with just over half (54%) in the FTSE250.

- The reporting lines in the FTSE250 are more varied, often reflecting the wider remit of the role. Just over one fifth (21%) of FTSE250 communications leaders report to the chief marketing officer (CMO) though these often have marcoms responsibilities or focus more on product communications. Around 13% report to the CFO reflecting the higher numbers of FTSE250 communications leaders that have investor relations responsibilities.

- Size, structure & responsibilities: The average FTSE20 team is around 300 strong, the average FTSE51 –100 around 35 and the average FTSE250, around 13, with many more generalists and ‘one-man bands’. FTSE100 teams can house heads of media, financial PR, internal communications, corporate responsibility & sustainability, and public affairs and digital. FTSE250 teams tend to focus on hiring ‘strategic doers’ to lead the function.

“FTSE100 communications directors tend to be a little more presidential with big teams that deliver a lot.”

FTSE250 CEO - Succession planning & recruitment: Larger FTSE100 communications teams means that there can be three or four senior executives who are able to deputise for the communications head. By contrast, in the FTSE250, there can be a significant gap in terms of seniority between the communications leader and their direct reports. Most of these firms look outside their organisation when it comes to replacing their communications leader.

- ExCom membership for communications: Formal representation of the corporate communications function on the executive committee is relatively similar across the two indices; in the FTSE100 around 50% are on the ExCom whilst in the FTSE250, it’s around 43%. Generally, the bigger the company, the more likely it is the communications function will be represented on the executive committee.

- Communications leaders’ salaries: There is a big gap between base leadership salaries in the FTSE100 (£300k) and the FTSE250 (£158k). This reflects the ‘premium’ often ascribed to FTSE100 roles. In the FTSE100 there is a direct correlation between market cap and a communications director’s remuneration. This is less so in the FTS250.

- Budget and resources: More communications staff, meatier annual reports, larger events (more media & analysts attending financial results), and increased number of international investor roadshows mean more expenditure in the FTSE100. Corporate and financial PR agency fees tend to be higher for FTSE100 firms, albeit that many communications directors are sceptical as to whether there’s more work to be done in a FTSE100 than in a FTSE250.

- EQ (emotional intelligence) can be more useful in the FTSE250: Some FTSE250 communications leaders observed that they often need higher levels of EQ than their FTSE100 peers. Having smaller teams, they argue, entails having to get more things done by influence than by mandate.

FTSE250 Communications Leader

11 More details available, hello@cayhillpartners.com